Beat the Summer Heat in Reno-Sparks

Reno packs some serious summer heat but also provides some of the best and most beautiful places to cool off! From Kayaking to water parks, we have plenty of cool activities to explore. Here are a few ways to beat the summer heat in Reno-Sparks:

KAYAKING

The Truckee River Whitewater Park is in the heart of downtown Reno. This 2,600-foot-long park has class 2 and 3 rapids for kayakers, canoes, and boats. Whether you’re a novice or new to the sport, kayak lessons and clinics are offered by Sierra Adventures.

PADDLEBOARDING

Stand-up paddle boarding (SUP) is one of the fastest-growing watersports. The Sparks Marina is an excellent location in Reno, and if you’re looking for more action, the Truckee River is a must! Lakeshore is based in Reno and has turned into a premier paddleboard spot. You can rent a paddleboard at Marina PaddleFit, and they offer clinics to learn new SUP skills.

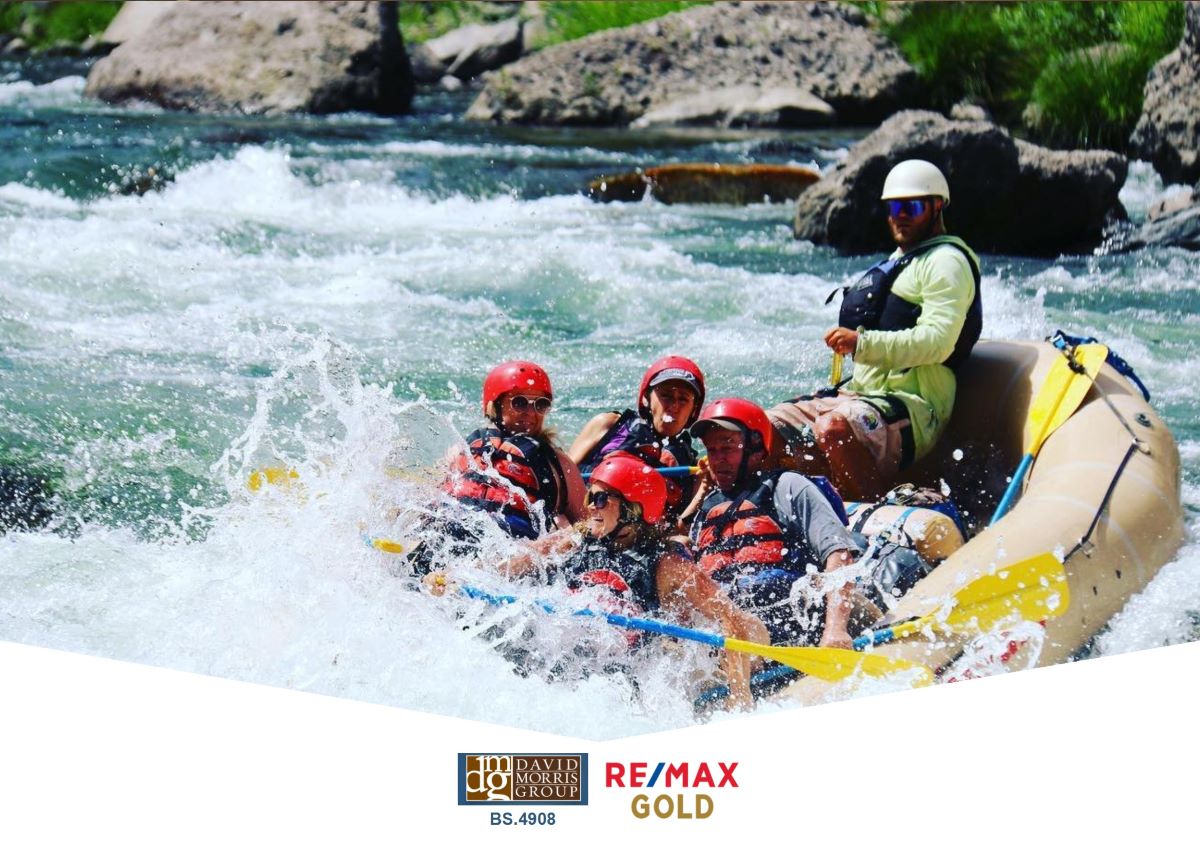

TRUCKEE RIVER RAFTING

Reno is a perfect place for whitewater enthusiasts. It’s close to the Truckee and the Carson River, both of which have fantastic whitewater options. The Truckee River delivers some wilder rapids with classes 3 & 4 if you’re down for a hair-raising adventure, while the Carson River is known for its milder rapids. The most popular route down the Carson River is a 21-mile stretch called “Hangman’s Run.” Tahoe Whitewater Tours and Sierra Adventures offer excellent guided tours down the rivers.

FLOAT ABOUT

Truckee River rafting is right in the heart of the city, with easy access through Wingfield Park. The park is the endpoint for most float trips, and you can find plenty of places to launch your raft. Popular launching points include Crissie Caughlin Park, Dorostkar Park, and Mayberry Park. If you’re looking for something less extreme, floating the day away is a great way to enjoy the river without rapids.

RENO-SPARKS’ WATER PARK

Wild Island Family Adventure Park offers summer fun for everyone! With water slides, a wave pool, go-karts, mini-golf, and bowling, it’s a great way to wear out the kiddos and have a little fun yourself.

We haven’t forgotten about fun in the sun at Lake Tahoe ~ Keep an eye out for our next blog to get the latest on the lake’s summer options!

To stay up to date on what’s happening around Reno, follow our blog, and if you have questions about the Reno-Sparks real estate market, contact the David Morris Group. We’re always happy to be your helpful guide. Give us a call at (775) 828-3292.