The Reality of Real Estate: Most Agents Won’t Say This, But Home Buying Can Wait. Here’s How You Can Prepare During COVID-19 Restrictions.

Being a first-time homebuyer can be a daunting journey during normal times, but faced with new challenges and changes amidst a pandemic may have you deciding to wait until some of the restrictions are lifted. As experienced agents, we know that buying and selling a home has to be done in line with you or your family’s needs. If you decide buying a home can wait, there are still steps you can take to be prepared for when the time comes.

Narrow down the neighborhoods or the areas that you would like to live in.

There are many great neighborhoods to choose from, especially in Reno and Sparks. Begin narrowing down the neighborhoods or the mile radius of the area you’d like to look in. Here are some questions to ask and answer when narrowing down where you’d like to live:

- How far are you willing to travel for work? Will you need to travel often for your job/is being close to the airport important?

- Which schools/districts would you like your kids to be a part of? Look at programs, graduation rates, and afterschool activities offered. What about higher education?

- Are community amenities like pools, picnic tables, and basketball courts important to you?

- Do you need to be near parks, trails, grocery stores, restaurants, stores, entertainment options, etc.?

- Are there community groups/publications that will help you and your family acquaint yourself with the new neighborhood should you move there?

Once you’ve come up with neighborhoods or areas you like, you’ll want to confer with your REALTOR® and ask a few questions, like:

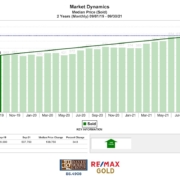

- How have property values changed in the neighborhoods over the years?

- Are there projected developments coming to the area? Is land in the area zoned for residential or commercial projects?

- Is there an HOA or community association, and if so, are there stipulations on what you can and can’t do with your home/property?

Save, save, save.

Currently, lenders are tightening their restrictions on who they offer funding to. To make yourself look like a smart investment for lenders, you’ll want to have enough money saved to cover the downpayment, closing costs, and several months of mortgage payments in the scenario that you are laid off.

Create a list of needs and wants you’re looking for in a home.

Most first-time homebuyers aren’t really sure what kind of home they’re looking for or aren’t thinking about the future and how their needs will change. You want a home that fits your current lifestyle but will continue to grow with you. You may have to compromise on a few items on your wishlist, but you should have a general idea of the kind of home you’re looking for. You may have to have tough conversations like:

- How many children do you want to have?

- Will you or your partner’s parents live with you in the future?

- Do you plan to work from home/homeschool your children?

Questions like this help you decide the number of bedrooms and bathrooms you’ll need, if a second master suite is necessary, and if you should seek out homes with a dedicated home office.

If you are looking for a dedicated team that can help you begin the process of searching for your future home, give the David Morris Group a call at 775-828-3292. We’re more than happy to help you from start to finish!